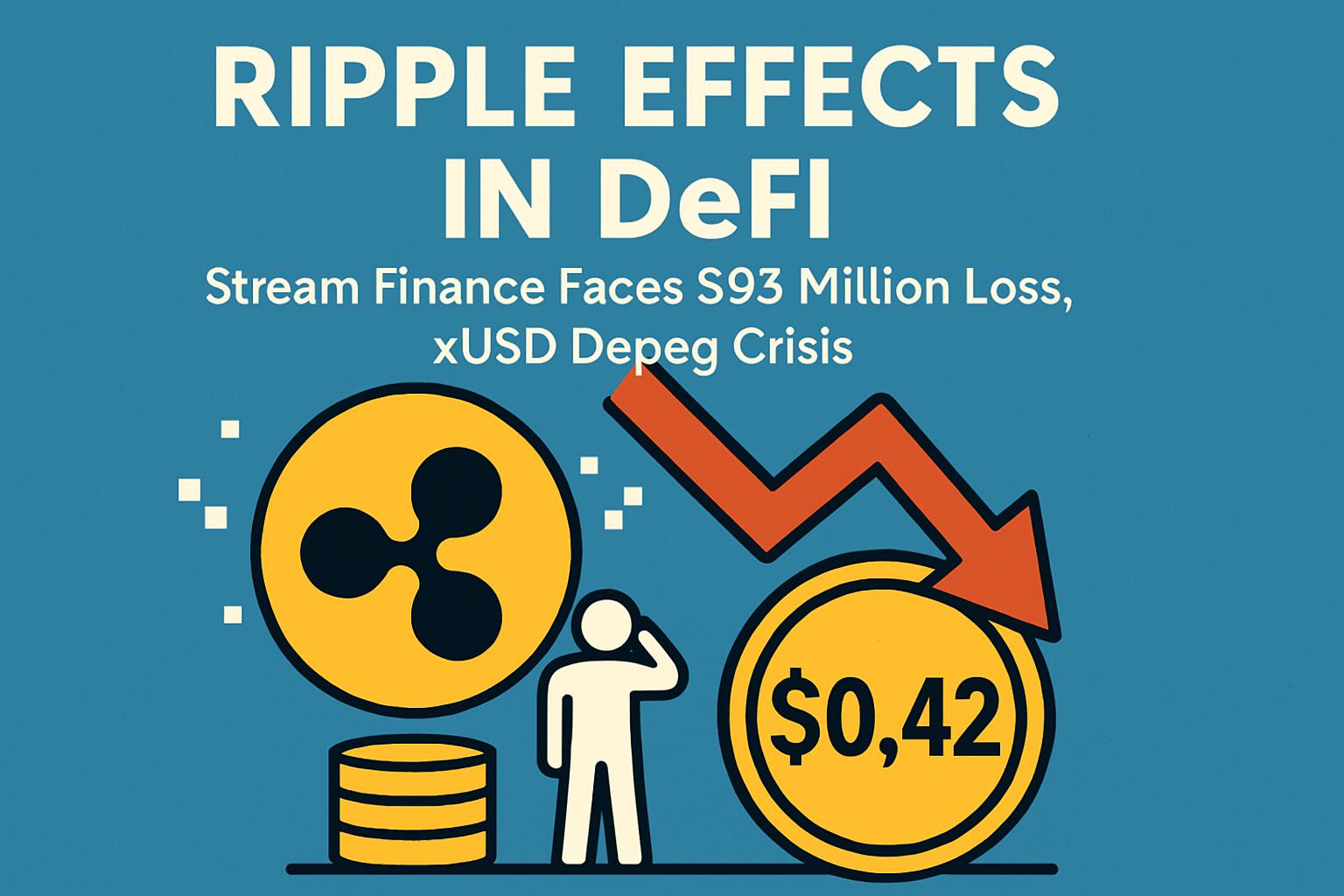

The decentralized finance world faced a fresh wave of disruption following the recent turmoil at Stream Finance. An unprecedented $93 million loss has shaken its foundation, prompting the platform to suspend all withdrawals and deposits as it grapples with the aftermath. Adding to the crisis, Stream’s flagship yield token, xUSD, has significantly depegged, plunging from its expected value to a shocking $0.42.

Investigation and Immediate Halts

Stream Finance reported that their fleet of external fund managers had disclosed alarming losses amounting to $93 million. To investigate this breach of trust and financial safety, the company has enlisted top legal expertise from Perkins Coie LLP. While the legal proceedings advance, Stream Finance has paused all transactions to prevent further financial hemorrhaging and is prioritizing the safeguarding of its remaining assets.

xUSD’s Critical Depeg and User Panic

The downfall of xUSD has amplified fears across the user base, as PeckShield promptly issued warnings about the token’s depeg—an indicator of structural instability. Once a stable representation of high-yield strategies, xUSD’s value has cratered, reflecting a volatile market environment exacerbated by liquidity crunches and diminishing trust.

Impact of Balancer Hack: Chain Reactions in DeFi

These events follow the recent cyber attack on Balancer v2, which sowed uncertainty across the DeFi sector. Layer-2 networks like Base and Polygon were on high alert, taking drastic steps such as hard forks and freezes to mitigate risk exposure. In the confusion’s wake, funds are fleeing from potentially affected protocols, deepening Stream Finance’s troubles.

High Leverage and Low Transparency: A Dangerous Mix

Chaos Labs highlighted the precarious strategy employed by Stream Finance using platforms like Euler and Morpho. By leveraging xUSD as both collateral and yield, the platform magnified risks, leaving its financial structures highly susceptible under stress. Consequently, Stream’s exposure to market volatility revealed fundamental vulnerabilities that had gone unchecked.

Reflection on DeFi: High-Yield’s Hidden Risks

In an environment chasing maximum yield, Stream Finance’s experience is a stark reminder of the dangers of complex financial products within DeFi. Omer Goldberg of Chaos Labs calls for urgent reform in risk management, emphasizing enhanced transparency and professional reserve verifications to shield users from similar crises in the future.

As the DeFi landscape evolves, this incident underscores the crucial balance between innovation and safeguarding investor interests, echoing broader calls for resilience in a rapidly changing financial frontier.

![[News] Bitcoin at a Turning Point? 10x Research Signals a Bullish Macro Shift Ahead](https://cryptoexplores.com/wp-content/uploads/2025/06/new20250616.jpg)

![[News] Binance Lists $HOME, the Gas-Free, Bridge-Free All-in-One DeFi App](https://cryptoexplores.com/wp-content/uploads/2025/06/news20250617.jpg)