Japan Moves to Redefine Crypto as Financial Products, Slashes Tax to 20%, Sets Stage for Bitcoin ETFs

In a groundbreaking shift for the global crypto landscape, Japan is preparing to reclassify cryptocurrencies as financial products, opening the door for crypto ETFs and tax reforms that would drastically reduce capital gains tax for individual investors from up to 55% down to a flat 20%. This change is part of the country’s broader “New Capitalism” policy agenda.

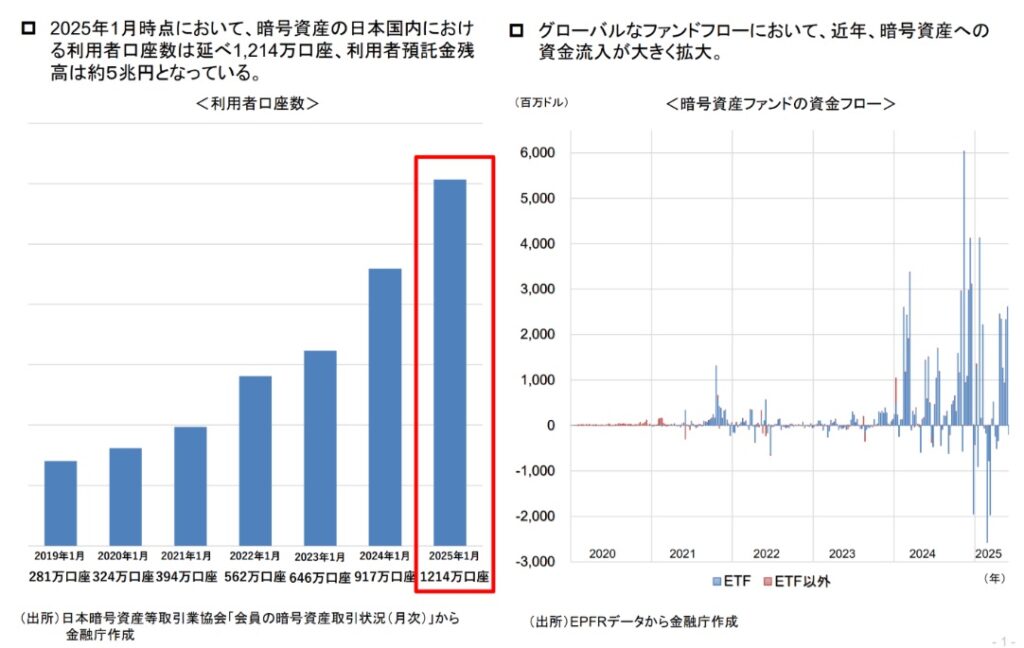

According to Japan’s Financial Services Agency (FSA), the country now boasts over 12 million active crypto accounts, with crypto investments outpacing those in forex and bonds among certain demographics—signaling strong retail demand.

1. Two Categories of Crypto Assets: Fundraising vs. Non-Fundraising

The FSA proposes classifying crypto assets into two categories based on their fundraising functions:

- Fundraising Type: Assets tied to project financing (e.g., ICO tokens) would be subject to stricter disclosures by issuers.

- Non-Fundraising Type: Assets like Bitcoin (BTC), Ethereum (ETH), or memecoins would require disclosures from exchanges, not issuers.

The FSA clarified that NFTs will not be regulated under this framework for now, given their diverse use cases and asset characteristics.

2. Three Pillars of Regulation: Compliance, Markets, and Insider Trading

Japan’s regulatory approach includes three focus areas:

- Compliance & Consumer Protection: Any promotional activities framed as “investment opportunities”—from seminars to online marketing—will fall under regulatory oversight to prevent fraud and misinformation.

- Market Infrastructure: While acknowledging that crypto market price mechanisms remain immature, the FSA plans to introduce baseline system management standards for exchanges. Unlike stock exchanges, crypto platforms will receive flexible and less restrictive oversight at this stage.

- Insider Trading and Info Abuse: The FSA is considering international practices (e.g., U.S.-style disclosures and EU bans on insider trading) to build future frameworks for preventing data misuse and manipulation.

3. Crypto as “Financial Instruments” Under the FIEA: Tax Rate Set to Drop

Crucially, the FSA is exploring amendments to bring crypto under the Financial Instruments and Exchange Act (FIEA)—the same law that governs securities and investment products. Once this is formalized, the capital gains tax on crypto would be aligned with that of stocks and mutual funds at 20%, a sharp drop from the current progressive tax rate of up to 55%.

This reform was included in the New Capitalism Implementation Plan, approved by Japan’s cabinet on June 13, 2025, and is now being developed by regulators.

4. Japan Eyes Spot Bitcoin ETFs Amid Global Momentum

One of the major motivations for Japan’s policy shift is to clear a legal path for crypto ETFs, especially spot Bitcoin ETFs, to compete with offerings in the U.S. The FSA cited that over 1,200 global financial institutions have already invested in U.S.-listed Bitcoin ETFs—including major players like Goldman Sachs and pension funds—highlighting the need for Japan to keep pace.

5. Crypto Adoption Surges: 12M Japanese Accounts, $34B in Assets

As of January 2025, FSA data reveals Japan has 12 million+ crypto accounts with aggregate holdings exceeding $34 billion. In younger, tech-savvy demographics, participation in crypto now exceeds traditional investment vehicles like forex and government bonds—signaling a major generational shift in asset allocation.

6. Stablecoin Ecosystem Matures: SMBC & SBI Lead the Charge

Japan is also warming up to stablecoin adoption. In April 2025, SMBC (Sumitomo Mitsui Banking Corporation) signed an MoU with Ava Labs, Fireblocks, and TIS Inc. to launch stablecoins pegged to the U.S. dollar and Japanese yen, intended for use in real estate, bond, and equity settlements.

Earlier in March, the FSA issued Japan’s first stablecoin license to SBI VC Trade, enabling it to support USDC-related services and prepare for cross-border settlements and digital finance use cases.

Conclusion: A Bold Step Toward Mainstream Crypto Integration

Japan’s reclassification of crypto assets and comprehensive reform strategy could become a model for advanced economies seeking to embrace innovation while maintaining regulatory safeguards. With ETF frameworks underway, tax clarity for investors, and stablecoin infrastructure gaining traction, Japan is positioning itself as a serious contender in the global race for Web3 leadership.

Let me know if you’d like a matching blog cover image, social media caption, or WordPress formatting for this post.

![[News] Bitcoin at a Turning Point? 10x Research Signals a Bullish Macro Shift Ahead](https://cryptoexplores.com/wp-content/uploads/2025/06/new20250616.jpg)

![[News] Binance Lists $HOME, the Gas-Free, Bridge-Free All-in-One DeFi App](https://cryptoexplores.com/wp-content/uploads/2025/06/news20250617.jpg)