DeFi Protocol Resupply Suffers $9.6 Million Exploit: Curve Founder Denies Ties, OneKey CEO Suspects Inside Job

Resupply Finance, a DeFi protocol closely linked in the community’s eyes to major players Convex and Yearn Finance, has fallen victim to a devastating exploit worth approximately $9.6 million. While Resupply has often been considered a subDAO related to these well-known protocols, Curve founder Michael Egorov publicly distanced Curve from Resupply. Meanwhile, OneKey founder Yishi — among the victims — has openly questioned whether the incident was a premeditated inside job.

How the Attack Happened: Oracle Manipulation and Immediate Laundering

Resupply Finance is a decentralized stablecoin lending protocol designed to generate yield through liquidity and stability in borrowing markets. Convex and Yearn Finance have historically played significant roles in supporting Resupply, with Convex itself built on top of Curve’s infrastructure to maximize capital efficiency for CRV stakers by enabling greater rewards without direct liquidity provision on Curve.

In this attack, the exploiter manipulated the price oracle in the ResupplyPair contract to inflate the price of the synthetic stablecoin cvcrvUSD. This allowed them to borrow $10 million worth of reUSD with just 1 wei of collateral, bypassing loan-to-value (LTV) checks and draining Resupply’s treasury almost instantly. The stolen funds were subsequently funneled through Tornado Cash, a crypto mixer known for obfuscating transaction trails.

OneKey Founder Alleges Possible Inside Job

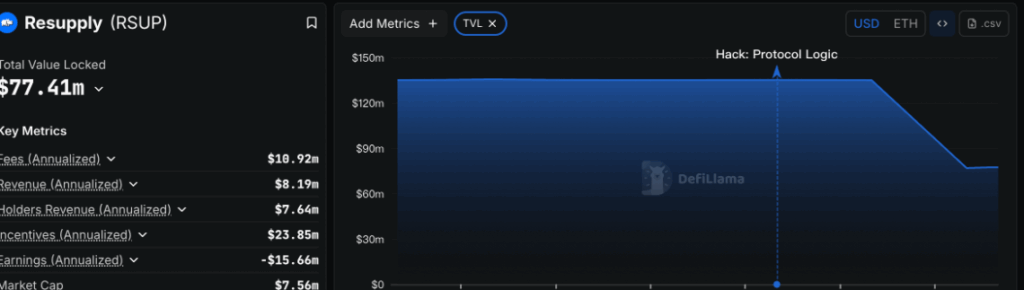

According to DeFi Llama data, Resupply’s total value locked (TVL) plunged from $135 million before the exploit to around $77 million after the attack.

OneKey founder Yishi, who suffered losses, expressed suspicion over the protocol team’s response, arguing they were slow to investigate the hacker and may have even orchestrated the exploit themselves. Yishi also reported being banned from Resupply’s official Discord channel after raising these concerns. He warned that if the protocol continued treating investors this way, he would resort to legal action.

Meanwhile, Curve’s founder Michael Egorov issued a statement clarifying that no one from the Curve team was involved in Resupply, although he admitted feeling disappointed since Resupply’s use of crvUSD had contributed to Curve’s growth.

Yishi reiterated that many investors were willing to deploy significant capital only because they believed Resupply was backed by Curve, Convex, and Yearn Finance — protocols with established credibility. He argued that without explicit or implicit support from these teams, few would have discovered or trusted Resupply in the first place.

Risk Warning:

Cryptocurrency investments are highly risky and subject to extreme volatility. You could lose your entire investment. Please evaluate your risk tolerance carefully.

![[News] Bitcoin at a Turning Point? 10x Research Signals a Bullish Macro Shift Ahead](https://cryptoexplores.com/wp-content/uploads/2025/06/new20250616.jpg)

![[News] Binance Lists $HOME, the Gas-Free, Bridge-Free All-in-One DeFi App](https://cryptoexplores.com/wp-content/uploads/2025/06/news20250617.jpg)