After more than two years of silence, stablecoin issuer Circle is making another bid to go public, having recently filed an S-1 with the SEC (source). As the issuer of USDC, Circle has weathered the bear market and now emerges with renewed momentum—and profitability. But is the stablecoin business model truly sustainable?

Let’s unpack Circle’s financial evolution since 2021, and assess whether its core revenue model can hold up in a changing macroeconomic and regulatory environment.

Table of Contents

- The Rise of Circle and USDC

- Interest Income: How Circle Profits From U.S. Treasuries

- Declining Margins and Revenue Sharing With Coinbase

- Cost Structure and Spending Priorities

- Is Stablecoin Issuance a Viable Business Model?

- Valuation Outlook: What Is Circle Worth Today?

The Rise of Circle and USDC

Stablecoins are digital assets pegged to fiat currencies like the U.S. dollar, often backed by reserves or managed algorithmically. As of mid-2024, the global stablecoin market cap exceeds $238 billion—up from $130 billion at the end of 2022. Tether (USDT) and USD Coin (USDC) control about 85% of that market.

USDC, which consistently ranks as the second-largest stablecoin, was originally launched in 2018 by the Centre Consortium—a joint venture between Circle and Coinbase. By August 2023, the Centre Consortium was dissolved. Citing improved regulatory clarity in the U.S. and abroad, Circle took full control over USDC issuance, governance, and smart contract management, consolidating operations in-house for tighter compliance and efficiency.

Interest Income: The Engine Behind Circle’s Revenue

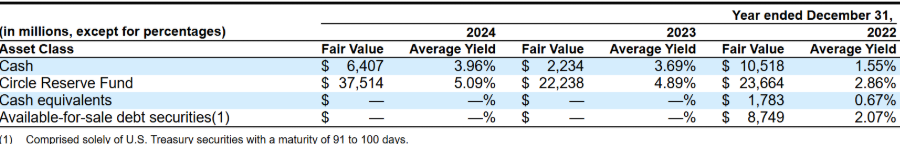

Circle’s primary source of revenue is interest income—earned on the reserves backing USDC, primarily invested in short-term U.S. Treasuries through a money market fund managed by BlackRock. With the Fed maintaining high rates during 2023–2024, Circle reported $1.676 billion in revenue for 2024, with 99% coming from reserve interest.

However, because of its partnership with Coinbase, a significant portion of that revenue is shared. Transaction and service fees make up just 1% of total income, signaling an overdependence on interest revenue.

Circle has since wound down non-core products like Circle Yield (a lending service) and seed investments to focus squarely on USDC issuance and reserve management.

Declining Margins Due to Revenue Sharing

Circle’s gross margin has steadily fallen, largely due to revenue-sharing agreements with Coinbase. From 2020 to 2024, gross margins dropped from 77% to 39%. Here’s what Coinbase received from Circle in reserve revenue sharing:

- 2024: $908 million (55% of Circle’s interest income)

- 2023: $691 million (48%)

- 2022: $248 million (34%)

While beneficial to Coinbase, these payouts significantly dilute Circle’s profitability.

Operational Spending: Where the Money Goes

Circle’s largest operational cost is compensation, which includes salaries, equity incentives, and retirement benefits—accounting for nearly 50% of its operating expenses. Administrative costs make up another 20–30%, driven primarily by legal and compliance fees related to its IPO preparation.

Measured by cost-to-income ratio, Circle improved from 361% in 2020 (deep in the red) to 76% in 2024, finally achieving profitability.

Is Stablecoin Issuance Still a Good Business?

Circle’s intense focus on reserve income makes it vulnerable. Unlike traditional banks that lend out deposits to capture interest spreads, Circle parks its reserves in Treasuries—safe but inflexible. This limits its ability to generate revenue independently of macroeconomic conditions.

To future-proof the business, Circle must diversify revenue streams, possibly by expanding payment infrastructure and enhancing transaction-based income.

From 2022 to 2024, Circle’s reserve yield grew from 2.86% to 5.09%, boosting revenue. However, as the Fed enters an easing cycle and cuts rates (already down 1% since late 2024), Circle’s earnings will likely come under pressure.

Dragonfly partner @TheOneandOmsy also warned that Circle’s high distribution costs and regulatory opening could invite competition from traditional financial institutions, putting Circle’s market share at risk.

What’s Circle Worth?

Circle’s reported book value as of December 31, 2024, was $1.178 billion, or $20.90 per share. According to PitchBook, Circle’s 2022 valuation stood at $7.7 billion, with analysts now estimating a potential market cap of $9 billion post-IPO.

Depending on investor sentiment toward stablecoins, Circle’s stock could price anywhere from $21 to $160 per share.

Final Thoughts

Circle’s IPO comes at a turning point for stablecoin regulation and adoption. While its financials show promise, the company remains heavily reliant on interest income. To evolve from a macro-dependent asset manager into a true fintech infrastructure leader, Circle must invest in long-term, transaction-driven growth.

Disclaimer: Cryptocurrency investments carry significant risks. Always conduct thorough research before making investment decisions.

![[News] Bitcoin at a Turning Point? 10x Research Signals a Bullish Macro Shift Ahead](https://cryptoexplores.com/wp-content/uploads/2025/06/new20250616.jpg)

![[News] Binance Lists $HOME, the Gas-Free, Bridge-Free All-in-One DeFi App](https://cryptoexplores.com/wp-content/uploads/2025/06/news20250617.jpg)